Table of contents

Table of contents- What’s Your Appetite For Supply Chain Risk?

- Are you ready for whatever the world will throw at you next?

- Where there’s a will, there’s a way

- How can your business prepare for risks to stay agile and resilient?

- “Sounds great, but what’s a supply chain risk appetite statement?”

- What are the benefits of a supply chain risk appetite statement?

- How can you build your risk appetite statement?

- So, what’s your appetite for risk?

- Supply chain risk FAQs

It seems like risk greets you at every turn these days, whether you’re navigating a heavily disrupted supply chain, trying to book a doctor’s appointment, or just getting on a train.

Risk, it seems, is the new normal.

As J.R.R. Tolkien once wrote: “It’s a dangerous business, going out of your door. You step into the road, and if you don’t keep your feet, there’s no knowing where you might be swept off to.”

In the last few years, we’ve experienced multiple ‘once in a lifetime’ events that have created risk.

The Covid pandemic, worldwide supply chain chaos, the Ukraine war, widespread inflation, the great resignation, extreme weather events caused by global warming, cyber-attacks… the list goes on.

Some have defined this period as a polycrisis.

A ‘polycrisis’ is a stream of varying crises that have a deep impact on the world, and your ability to navigate business around them.

Everything feels like a deterioration of an already difficult situation, and begs the question ‘are you prepared?’

Of course, with the varying genres of problems on the menu, be it geopolitical, economic, or climate, a common response to that question would be ‘prepared for what?’

Are you ready for whatever the world will throw at you next?

Chances are you’re not. Many others are in the same boat.

But to lack preparation because you’re behaving as if nothing’s changed isn’t good enough. You can’t stick your head in the sand and hope for the best.

This outdated approach to risk management has no place in any part of your business, let alone your supply chain.

After all, these disruptive events can have lasting effects on your business and even affect other businesses, or the wider world as a whole.

Remember the Suez Canal debacle?

$9.6 billion in global trade on the scrap heap. Countless businesses around the world were disrupted for weeks. And all this is due to one container ship running aground.

You could argue: ‘It’s one of those things we can’t control’. But what global event can’t be described like that?

Sure, you alone probably could not have done anything about the Ever Given’s fateful voyage. But perhaps there are steps you could’ve taken to protect your businesses from the aftermath.

And hence, today’s article is all about contingency planning and strategic thinking.

Where there’s a will, there’s a way

When it comes to risk planning, many companies look at their ability to handle it by analysing the capability of each department.

Perhaps, you have heard similar concerns voiced in your organisation:

- “How will our finance department handle another recession?”

- “How can sales continue to produce good numbers if we can’t get products from our supplier in the East?”

- “How can our customer service team keep people happy if there’s a significant delay in shipping?”

This inward-looking approach doesn’t consider the business as one entity. It looks at each department and tries to address scenarios which are impossible tohandle individually. The issue, however, is that these problems often affect the entire company.

This attitude doesn’t see sales and marketing as connected. Or supply and finance. Or customer service and ops.

You can clearly see this problem illustrated before your very eyes by using ‘stoplight’ charts with red, amber or green coloured boxes where risk’s indicated per department.

On the face of it, you can see where there’s an inherent risk for certain situations and where that risk is felt most strongly.

Cut off supply for example, and your sales department will suffer, illustrated with an orange or red box.

But what these charts fail to highlight is the interconnectivity that every department of your business shares.

Yes, if you cut off supply, sales will be impacted. But so will customer service. And finance. And ops. And marketing. Do stoplight charts show risk and likely impact? Or do they show which departments don’t work well with one another and the influence of company politics?

One of the main reasons some companies feel unprepared for new risks that arise is their historical prioritisation of financial resilience over operational resilience. So, should working capital fall below the required standards, there’s a strategy available.

But if they suddenly find themselves unable to complete customer orders, there isn’t.

It begs the question…

How can your business prepare for risks to stay agile and resilient?

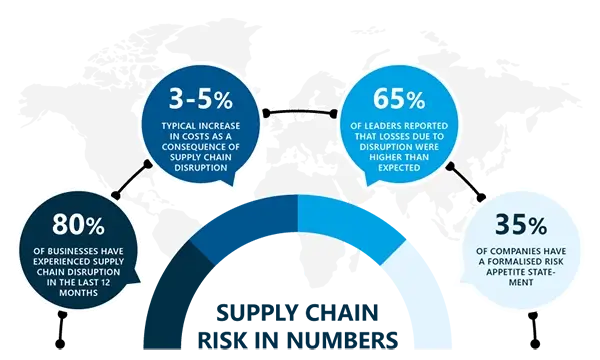

The vast majority of businesses have experienced a supply chain disruption in the past year. It’s estimated 80% of companies have, which is quite a staggering number.

When a supply chain disruption rears its head, businesses can see a 3-5% increase in expenses and a 7% decrease in sales. See, the section on interconnectivity above.

According to a recent report, 65% of business leaders said losses related to the supply chain were higher or much higher than expected over the last two years.

In a period where risk is the new normal, your company must have a framework to judge and manage it.

Most don’t.

Just 35% of companies have a formalised risk appetite statement, and even fewer (11%) have reached the maturity level of function-specific risk appetite statements.

To manage and avoid risk as best you can, building and deploying a risk appetite statement is a robust option. It’ll give you the ability to evaluate supply chain risk, disruptions, quality issues and delays and find mitigation options by prioritising your efforts to find cost solutions. Below we’ll investigate how you can build one.

“Sounds great, but what’s a supply chain risk appetite statement?”

A risk appetite statement assesses your company’s ability to handle risk in your supply chain operations. It’s a single document that defines risk and the level you’re able to handle. It gives specific directives on the types of risk that might be acceptable and the types that aren’t.

A well-defined risk appetite statement analyses your risk tolerance levels, risk priorities, risk governance, communication and reporting.

If you’re wondering how one might work in conjunction with your stoplight chart, a risk appetite statement will look at different areas of the business and the supply chain too.

But whilst looking at procurement, production, transportation, and inventory management, you may gain a view of specific thresholds for factors like disruptions, delays, quality issues, financial risks, and compliance risks.

A strong risk appetite statement will give your supply chain a robust framework for making good decisions. You’ll gain a better grasp of risk assessment, risk management and strategies to mitigate.

You will be better positioned to prioritise company resilience, enhance your supply chain performance and the chances of your wider business remaining unaffected by upheaval, no matter where it comes from next.

And as a supply chain manager or director, you’ll be able to make far better choices, informed by fact and strong reasoning. And you can make these decisions in line with the wider company’s ability to handle risk and its overall objectives.

What are the benefits of a supply chain risk appetite statement?

Preparing one will help your business navigate the unknown. That much is clear. But here’s a breakdown of some of the other benefits of creating a risk appetite statement.

Risk boundaries become more obvious

A risk appetite statement will show how much risk various departments and areas of your business can face.

Knowing how much risk you can take on will help you make better decisions. And knowing those decisions won’t impact the wider business will ensure you’re on the right side of history should the risk turn into an actual situation. This should help you ensure the steps you take as a business are generally risk-averse.

Supply chain risk & business alignment

Making sure your supply chain is in tune with your wider business is imperative to a well-run company. It’s one of the principles we regularly talk about with sales and operations planning (S&OP).

The strategic objectives you have as a business must be aligned with your supply chain, and vice versa. A strong risk appetite statement will prioritise the risks you take, based on their hypothetical impact:

- How much do they affect your strategic goals?

- How do they impact the allocation of resources and efforts?

- Are they assigned to the most crucial areas?

Making sure the gambles you take are well aligned will increase the effectiveness and relevance of your risk management objectives.

Proactive risk management

Just like stepping out of your front door in the morning, some risks are worth taking. But which ones?

A risk appetite statement will enable proactive risk management throughout your supply chain. It will show potential risks, help you create ideas for mitigation, and install controls before they happen. Being proactive in the face of risk will rarely not pay off.

Make better decisions

Some supply chain decisions aren’t obvious. There’s often as much risk in taking a strategic decision as there is in not making a move. The outcomes of both might be complex and mean negative ramifications in other areas of the business.

With a risk appetite statement, you’ll have a framework for analysing risks and a much better understanding of the outcomes of the choices you make. Risk tolerance, risk priorities, and risk mitigation strategies should all be easier to find.

Confidence from stakeholders

You should never underestimate the impact that confidence in your ability can have on business.

If those you employ and work with don’t have faith that you can meet risk head-on, and navigate around that risk, it won’t be long before they’re working for someone they do have faith in.

A risk appetite statement will create far greater confidence in your ability, and the company’s capabilities.

Firstly, it shows risks are being considered. Which is a good start for most. But it also shows decisions won’t be made lightly or in the face of the facts.

Transparency and great communication are two major contributors to good supply chain management. A strong risk appetite statement will showcase both.

As a result, the relationships with your customers, suppliers, investors, and regulatory bodies will be based on trust, collaboration and fact.

How can you build your risk appetite statement?

To instil confidence from the team around your ability to navigate risk, you need to show them you’re carefully considering it. Wherever it might come from.

Follow the steps below to create your risk appetite statement.

Step one: Encourage risk appetite buy-in.

Getting your company stakeholders on board is crucial.

That means internal stakeholders, external partners and suppliers. You absolutely must have cooperation for business goals across every function of your business.

Your company’s growth ambitions and ability to compete depend on it. You should think about cost optimisation, innovation and risk management.

Fail to do this and your business will have to deal with skewed priorities, programme failure, cost increases, and ineffective innovation and risk management.

Before creating your supply chain risk appetite statement, your goal is company-wide education. Define the concept and communicate why creating one can be so effective.

Step two: Assessing your supply chain risks

This next step is all about highlighting the potential risks to your supply chain, whether they’re in the form of shifts in demand (due to inflation), the reliability of your suppliers (as a consequence of Covid), transport disruptions (Suez Canal), regulatory changes (Brexit), or natural disasters (climate change).

How much of a disruption would another event like the above have on your company’s success and strategy?

Step three: Explore risk preferences

Plenty of leaders in the supply chain take step two too far. They look at every single risk that might reach their business. Listing everything that might affect the company seems like good practice but it can limit your ability to analyse and prioritise the most significant risks.

To give your potential risks a weighting, holding a workshop can be an effective solution.

A workshop will give you the ability to talk through potential risks with each department and assess how much of a problem that risk might be. It’ll also get department members into the mindset of risk mitigation and thinking about how they might navigate such a risk should it arise.

By doing this, you’ll take the risk from the world of hypothetical to real-life contingency planning.

Step four: Business input and drafting

While discussing potential problems, you’ll find some team members who don’t know the right way to approach them. That’s natural if the risk seems unlikely, hasn’t been encountered before, or there’s a lack of experience in a particular team.

Creating your risk appetite statement with your team should ensure every member has full visibility and clarity on how to react.

Ask yourself if the risk appetite statement you’re preparing is useful? Is it clear? Do your managers know how to react in the unfolding situation? Do current and potential suppliers know the best course of action?

If not, they need to.

Step five: Communication

Like many strategies in business, there’s a top-down approach. Your C-suite will make a decision and notify those below them of the plan.

This isn’t always a bad thing, but a risk appetite statement can lead to the sharing of information being left to chance. An ill-informed team is an ill-equipped team.

And the result of that is wrong decisions being made, or decisions for the wrong reasons.

Your people are there to make decisions for the good of the company so they need to know the parameters that apply. And that starts with strong and continuous communication.

Step six: Continuous review

Reviewing and updating your risk appetite statement regularly is the only way to make sure it’s constantly relevant.

Is a risk you perceived as relevant and likely 12 months ago still on the horizon? Do you view Covid as less risky to your supply chain the longer time goes on

Could another pandemic have the same disruption level? Or are you better prepared now?

Only with regular reviews and assessment can you ensure your risk appetite statement is useful and the decisions being taken in your business are sound.

So, what’s your appetite for risk?

Everything in life carries a risk. Your supply chain’s no different. Those risks that come from external sources can be a constant bane to your ability to see success.

But sticking your head in the sand is the riskiest strategy of them all.

With regular review, a risk appetite statement could be your superpower to mitigating every potential problem on the horizon.

And even when a specific risk hasn’t been considered and rears its ugly head, the organisational shift you’ll achieve by preparing a risk appetite statement will see you better prepared and gain buy-in from every corner of your supply chain.

Supply chain risk FAQs

What is supply chain risk management?

Supply chain risk management involves identifying, assessing, and mitigating potential disruptions to enhance supply chain resilience and performance.

How do you identify supply chain risk?

There are many sources of risk throughout the supply chain. To identify supply chain risk, conduct thorough assessments of internal and external factors, and analyse vulnerabilities and potential disruptions.

What are the common types of risks that can affect the supply chain?

Common types of risks that can affect the supply chain include: natural disasters and weather-related disruptions, supplier disruptions, transportation delays, economic fluctuations, political and regulatory changes, cybersecurity threats, and market uncertainties.

How does supply chain visibility contribute to better risk management?

Supply chain visibility provides real-time insights into the movement of goods, inventory levels, and potential disruptions, allowing companies to proactively identify and address risks. With enhanced visibility, businesses can make informed decisions, implement timely risk mitigation measures, and build a more resilient supply chain.

How often should companies review and update their supply chain risk management plans?

Your risk appetite statement should be regularly reviewed and updated annually or when significant changes occur in the supply chain. These changes include new suppliers, markets, technologies, or regulations.