Table of contents

Table of contents- Days Inventory Outstanding (DIO): A critical link between operational and financial efficiency

- What Is the Days Inventory Outstanding (DIO) Formula?

- Days Inventory Outstanding: A Practical Example

- What Is Days Inventory Outstanding (DIO) for?

- Difference Between Stock Rotation and Days Inventory Outstanding

- Days Inventory Outstanding and Management Efficiency

- Days Inventory Outstanding (DIO) FAQs

Aurea mediocritas. That is, the “golden mean” or rather the middle ground between two extremes.

In the realm of inventory management, aurea mediocritas embodies the ideal equilibrium between avoiding excessive stock accumulation, which risks obsolescence and ties up capital, and preventing recurrent stockouts, which can result in lost sales and customer dissatisfaction. Attaining this delicate balance is the ultimate objective for any competitive organization.

To reach this balance point, supply chain professionals use various KPIs to monitor the state of inventory in order to avoid excesses and shortages. Days Inventory Outstanding (DIO) is an invaluable tool in the endeavour.

What Is the Days Inventory Outstanding (DIO) Formula?

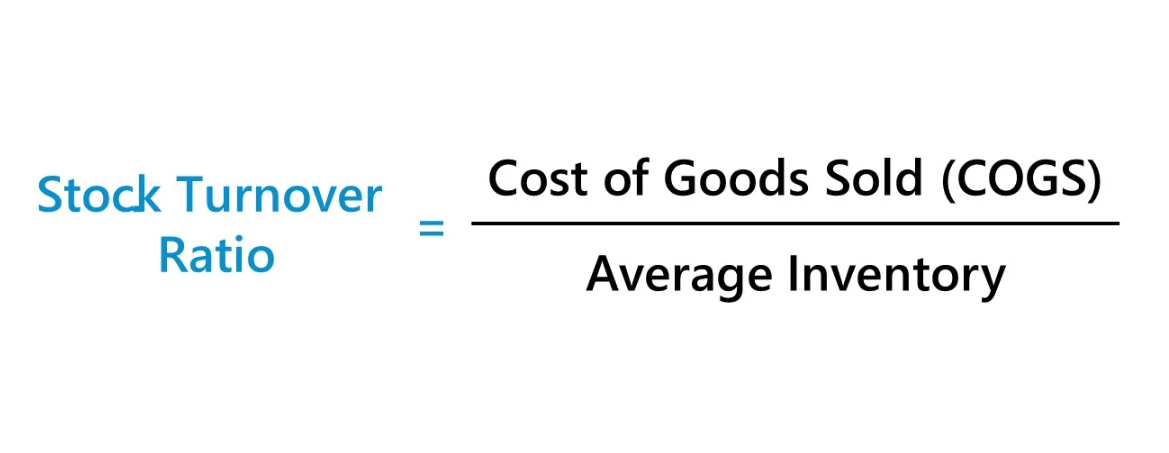

he basic formula for calculating the Days Inventory Outstanding (DIO) is:

In the formula we distinguish two concepts:

Average Inventory: The average value of inventory over a specified period of time, usually one year. Average Inventory: The average value of inventory over a specified period of time, usually one year.

Cost of goods sold: These are the costs incurred by an organisation in the sale of its products or services.

By dividing the average inventory by the cost of goods sold and multiplying it by the period we want to analyse (usually one year), we obtain the average number of days it takes for a company’s inventory to be sold.

If we want to talk about working days, we would multiply by 52*5 = 260 days instead of 365 days.

This gives us a measure of how efficiently the company is managing its inventory.

Days Inventory Outstanding: A Practical Example

Imagine you are an appliance dealer and you want to calculate the DIO for different brands of refrigerators. Well, to start with, we should establish the time period we want to calculate for the inventory days (as mentioned above, it is usually a year) and collect the following data: the average annual inventory and the cost of goods sold.

| Brand 1 | Brand 2 | Brand 3 | Brand 4 | |

| Average Annual Inventory | 5000 | 2200 | 3000 | 900 |

| Cost of Sales | 39000 | 45000 | 47000 | 16000 |

| # Days In Period | 365 | 365 | 365 | 365 |

In order to determine the DIO of each brand, we would carry out the following operations:

- Brand 1: (5,000 /39,000) x 365 = 46.80 inventory days

- Brand 2: (2,200 /45,000) x 365 = 17.84 inventory days

- Brand 3: (3,000/47,000) x 365 = 23.29 inventory days

- Brand 4: (900 /16000) x 365 = 20.50 inventory days

| Brand 1 | Brand 2 | Brand 3 | Brand 4 | |

| Avarage Annual Inventory | $3,000 | $1,000 | $5,000 | $1,500 |

| Cost of Sales | $35,000 | $40,000 | $54,000 | $20,000 |

| # Days In Period | 365 | 365 | 365 | 365 |

| Days Inventory Outstanding | ? | ? | ? | ? |

To determine the DIO of each brand:

DIO Brand 1: ($3,000 / $35,000) * 265 = 31.29

DIO Brand 2: ($1,000 / $40,000) * 365 = 9.13

DIO Brand 3: ($5,000 / $54,000) * 365 = 33.80

DIO Brand 4: ($1,500 / $20,000) * 365 = 27.38

What Is Days Inventory Outstanding (DIO) for?

As mentioned above, Days Inventory Outstanding is a KPI. Specifically, this performance indicator is used to measure the number of days that, on average, a company keeps a product in stock – be it a raw material, component or final item – before it is sold.

Inventory Management

On the one hand, Days Inventory Outstanding helps companies assess the efficiency of their inventory management by measuring how long inventory remains in the warehouse before it is sold. This allows companies to identify opportunities to optimise their inventory processes, such as reducing excess stock or improving turnover.

Cash Flow Management

Similarly, by calculating the average time inventory remains in the warehouse before it is converted into sales, DIO provides information on how long capital is “tied up” in products. A lower DIO indicates that capital is converted more quickly into sales, which can improve the company’s cash flow.

Obsolescence Risk Management

A lower DIO also means there is less time for inventory to become obsolete or unsaleable. By monitoring DIO, companies can proactively identify and address the risk of obsolescence, which helps reduce losses associated with obsolete products.

How to Interpret the Days Inventory Outstanding

To interpret Days Inventory Outstanding (DIO), it is necessary to understand how it relates to a company’s operational and financial efficiency. Obviously, what we mean by “high DIO” or “low DIO” will depend on the company and the industry. However, let us see how a general interpretation of this KPI could be carried out.

Low DIO

A low DIO is generally considered favourable. It indicates that the company is selling its inventory quickly, which can be a sign of efficient stock management and high demand for its products. This can result in better liquidity, as the company converts its inventory into cash more quickly. However, an extremely low DIO can also indicate a worryingly low level of inventory, which could result in order fulfilment problems if demand increases unexpectedly or if there are disruptions in the supply chain.

High DIO

A high DIO can be problematic as it suggests that the company is taking longer to sell its inventory. This can indicate a number of problems, such as overstocking, product obsolescence, low demand, or supply chain management issues. A high DIO can negatively affect a company’s profitability, as the costs associated with warehousing and holding inventory can increase. In addition, a high DIO may also be indicative of improved operational efficiency and reduced liquidity.

DIO Differences by Sector

Days Inventory Outstanding (DIO) can vary significantly between different sectors due to differences in the nature of products, product lifecycles, business models, and industry practices.

For reference, here are some examples of sectors with very different DIOs:

FMCG Retailers: Low DIO

In this sector, where products have a high turnover and constant demand, a low DIO would be the most common. Products such as food, beverages, and personal care items tend to have short lifecycles and predictable demand, leading to a lower DIO.

Building Materials Industry: High DIO

In this sector, where products are bulky, expensive, have less predictable demand, and usually a long lead time, high DIO is common. Construction materials can remain in inventory for extended periods due to the seasonal nature of construction and long-term projects.

Fashion Industry: Variable DIO

In fashion, products often have short lifecycles due to changing trends and often have higher prices. DIO can vary according to the season and demand for specific products. Some fast fashion products may have a low DIO, while luxury items may have a higher DIO due to exclusivity and lower turnover.

Difference Between Stock Rotation and Days Inventory Outstanding

Stock turnover and Days Inventory Outstanding (DIO) are two metrics related to inventory management, but have slightly different approaches. Interpreting the two provides complementary insights into a company’s operational efficiency.

As we have already extensively reviewed what DIO is, let us look in a little more detail at what stock rotation is in the context of inventory management.

Stock Rotation

Stock turnover is also a measure of how quickly a company sells and replaces its inventory in a given period of time, usually a year. It is calculated by dividing the cost of goods sold (COGS) by the average inventory over the same period. The basic formula is:

Stock turnover indicates how many times inventory has been sold and replaced during the specified period. A high stock turnover is generally considered favourable, as it suggests that the company is selling its inventory quickly and replenishing it effectively.

Therefore, the main difference between the two metrics lies in their temporal focus: stock rotation focuses on the number of times inventory is sold and replaced in a year, while DIO focuses on how long it takes for inventory to be sold in terms of days.

Days Inventory Outstanding and Management Efficiency

Finding the “golden mean” or the “virtue of the middle ground” in stock management is of great importance for business competitiveness. Maintaining a balance between excess and shortage of inventory is key to avoid risks of obsolescence and lost sales.

KPIs such as Days Inventory Outstanding allow businesses to continuously monitor and adjust inventory to ensure efficient operation and customer satisfaction. In this delicate balance lies the true virtue of successful stock management.

Days Inventory Outstanding (DIO) FAQs

How should DIO be applied to the management of a company?

DIO should be implemented through regular monitoring of inventory and cost of goods sold, identifying significant trends and variations. Companies should set specific DIO objectives based on the characteristics of their industry and business model, and then implement measures to optimise inventory, improve operational and financial efficiency, and ensure proper cash flow management to maintain a competitive market position.

What other KPIs, other than DIO, can be used to measure the efficiency of stock management?

In addition to DIO, other KPIs to measure the efficiency of stock management include the inventory turnover rate, which assesses how many times inventory is sold and replaced in a given period, and the OTIF, which measures the company’s ability to meet customer demand in a timely and complete manner. The obsolescence rate is also a common indicator when measuring the efficiency of inventory management.

What are the risks of too high a DIO and too low a DIO?

A Days Inventory Outstanding (DIO) that is too high can lead to obsolescence problems, excess inventory and low liquidity, affecting profitability and operational efficiency. On the other hand, a DIO that is too low can lead to inventory shortages, lost sales and loss of customer satisfaction due to the inability to meet customer demand, which can also negatively affect the company’s profitability and reputation.

How do I know which DIO would be right for a referral for my business?

Determining the right DIO for a specific business benchmark involves considering a number of factors, such as industry, product life cycle, product lead times, market demand, and business objectives. A detailed analysis of these elements, as well as comparisons with similar companies within the industry, is essential to establish a target DIO that ensures efficient inventory management and meets the operational and financial needs of the company.